Following a CBN order restricting banks and financial institutions from cryptocurrencies transactions, Nigerians have embraced Peer-to-Peer (P2P) trading on a larger scale. P2P is not new. In fact, it is one of the oldest forms of trading cryptocurrencies. It is the very principle upon which decentralised financial transactions rest.

P2P works by connecting people who have crypto tokens to people who have money and are ready to buy the tokens. Usually, a list of traders who have the preferred token is shown to the buyer who now chooses the trader he or she wants to buy from.

Centralized exchanges started gaining grounds as more people lost money due to crypto scams which often mean that buyers do not get what they pay for in full or at all. Now that more people are reverting to P2P trading in Nigeria, it is important to trade in the best way possible so as to avoid telling stories that touch.

So without further ado, here are the red flags to look out for to avoid getting scammed while trading P2P.

Contents

Absence of escrow partner and refund policy

P2P makes it possible to send money or crypto directly to a trader in return for crypto, the risk is that one of the two parties may choose not to hold up his or her end of the transaction. An escrow service acts as an overseer for all the parties involved in a transaction. If one person makes a payment for an amount of crypto, the payment is held by the escrow service until the crypto is delivered to the buyer. Afterwards, the seller receives the agreed payment for what was exchanged.

Timothy Ayodele, Chief Executive Officer of FireSwitch, insists that lack of escrow service is a major flag for any crypto trading platform offering P2P services. FireSwitch creates tech solutions for businesses.

“The risk of transferring Naira to someone else in exchange for bitcoin is genuine, and this is where escrow platforms like ReniTrust come in. ReniTrust holds the Naira from the buyer until he or she confirms that the crypto tokens have been received in full. Then and only then will the Naira payment be made to the seller.”

Timothy Ayodele

Binance has a crypto exchange service that secures users’ payment until the buyer confirms that the crypto has been received in full. RoqquPay has what is similar to an escrow system. It uses individuals that are marked as agents to collect money and facilitate crypto transfers and wallet funding. It is faulty, however, because the money is sent directly to the personal account of the individuals. Thus they can be misused or some other issues may cropup with the agents.

Exchanges with an escrow system have a refund policy and can return the buyer’s payment if the seller failed to deliver or both parties want to cancel the deal. Lack of an escrow system in P2P exchanges means that customers have very low chances of getting refunds if things go awry.

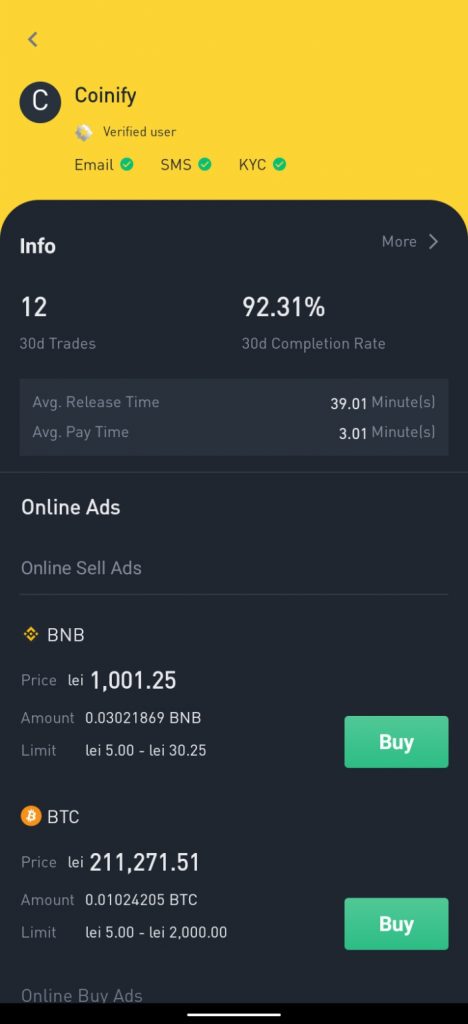

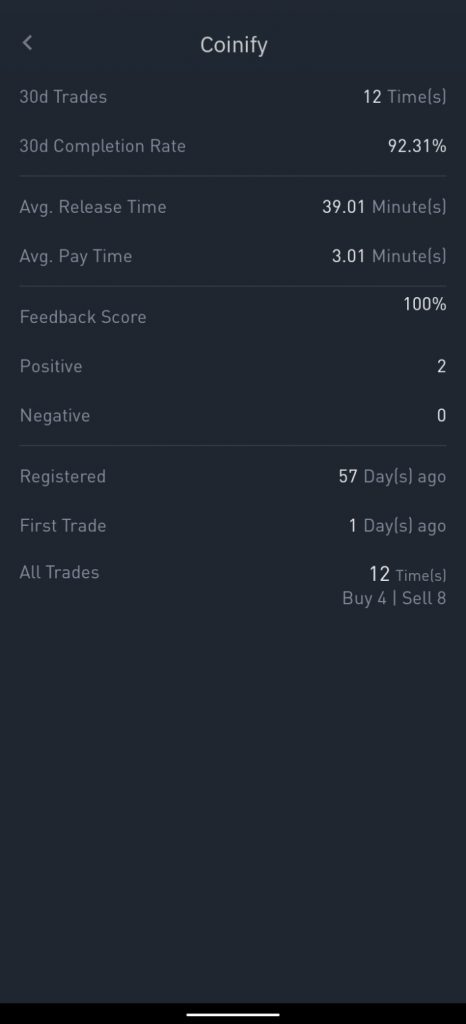

Number of successful trades done

Apps like Binance provides you with details on the number of trades completed by a P2P trader, the average time it takes them to transfer the crypto, user reviews from the transactions and feedback score. These details show that the P2P trader is credible and has been trading successfully with other people.

Before moving funds through a P2P platform, it is important to check if the platform provides details of the trading activities of merchants. The absence of these details is a red flag that means you cannot verify the authenticity of a trader. Platforms like Binance provide details of past transactions of merchants including the positive and negative reviews they have gotten.

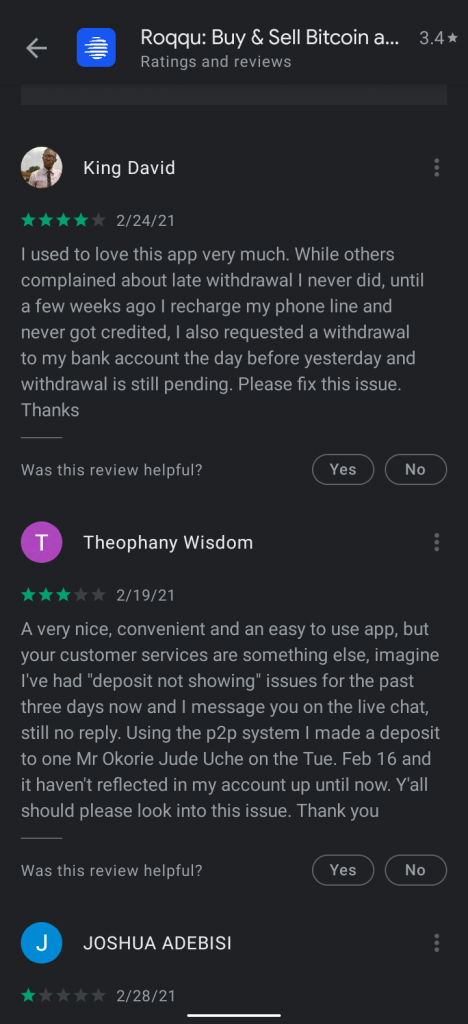

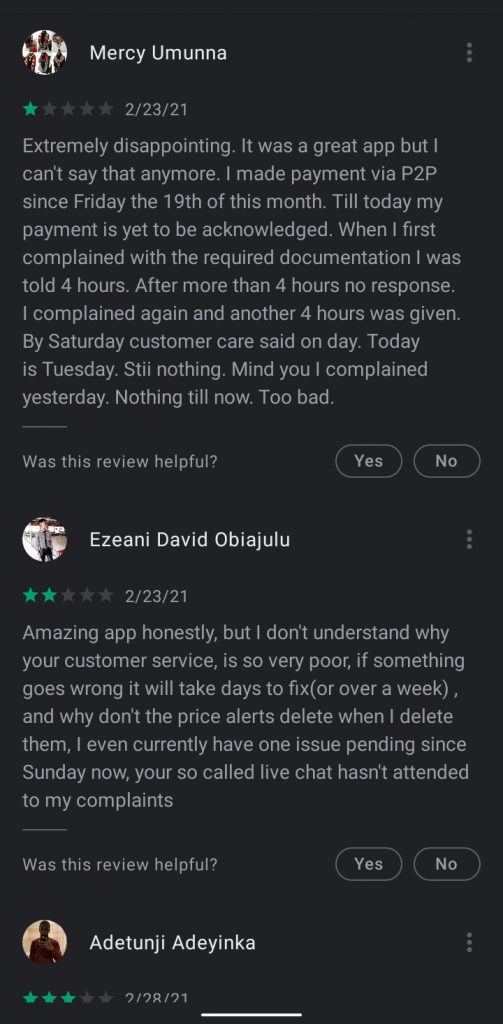

Poor ratings on the Playstore

Playstore is a place where most Nigerians feel free to speak their mind about apps that they use. When choosing a P2P exchange app to download, the comment section can help find out the experience of other people who have used the app. It is a red flag if people complain that they are not able to withdraw or make purchases easily. It is also a warning sign if people can’t reach out to a customer care agent and get responses quickly, or are unable to access any service the app is supposed to provide.

If the negative reviews are very recent and there is no recent positive review to show that the issues have been resolved, it is very likely that you are walking into trouble.

Take for example this kind of review: “Amazing app honestly, but I don’t understand why your customer service, is so very poor, if something goes wrong it will take days to fix(or over a week), and why don’t the price alerts delete when I delete them, I even currently have one issue pending since Sunday now, your so-called live chat hasn’t attended to my complaints.”

Complaints like David’s show that this app currently has challenges delivering some of its services. When the reviews remain constantly negative from previous users over time, it is a red flag suggesting that the user experience will be anything but smooth.

Lack of social media presence (user comments)

The last flag to watch out for is a robust and active presence on social media. When there are complaints or questions and other channels of communication are not working, the social media handles of crypto trading brands are usually the most viable options. Having a social media page is not enough, the trading platform has to be active and have a voice and soul that customers can interact with online.

This gives confidence to users of the P2P service that the brand can be found and dragged online, whichever the case may be. The negative reviews about the RoqquPay app and what the company is doing about it are better explained and clarified by tweets from both the company and its customers.

Lack of an active social media presence is bad news when choosing a P2P platform.