Again, the October inflation rate defied market reality as data released by the National Bureau of Statistics (NBS), yesterday, showed prices of goods and services have continued to increase at a slower rate.

Amid escalating prices, the October Consumer Price Index (CPI), a measure that examines the weighted average of prices of a basket of goods and services, showed inflation decelerated to 15.99 per cent (year-on-year) in October 2021 as against 16.63 per cent recorded in September.

According to NBS, the inflation rate has decelerated for seven straight months, a rare trend in recent history. The headline inflation, driven by soaring food prices, had accelerated consistently for about three years, hitting 18.17 per cent in March. Since April, the rise in inflation has been slower, according to NBS statistics.

But some economists and other stakeholders have dismissed the position of NBS, which they said needed to do more to convince Nigerians, especially those who rely on their data for research and critical decision-making, that the figures are not doctored to achieve a predetermined objective.

Contrary to the position of NBS, households across the country are trapped in a persistently rising cost of living.

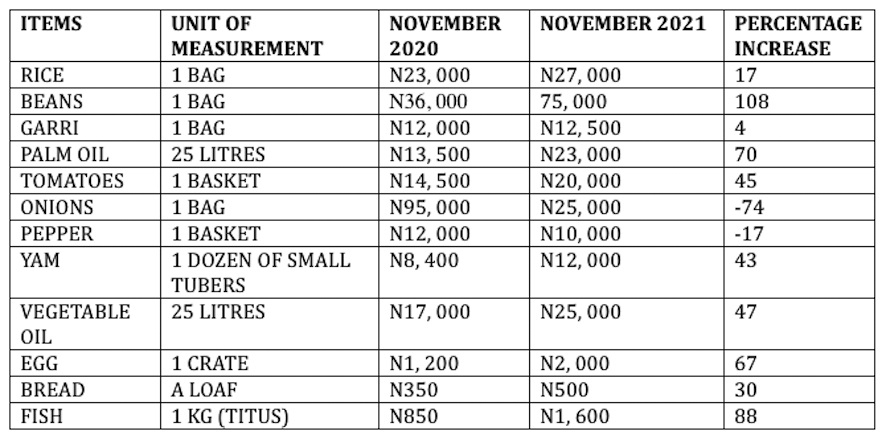

Prices of basic food items increase at a double-digit percentage every other week. A market survey conducted by The Guardian revealed that the cost of protein had increased by almost 100 per cent in the last one year. The same thing applies to certain plant-based food crops such as beans.

In Lagos, a crate of eggs (30 units) in most supermarkets sells for between N1,800 and N2,150. On the street, the price has also increased from N1,200 in 2020 to between N1,700 and N2,200 depending on the size. That puts the year-on-year (YoY) increase at approximately 62 per cent.

A kilogramme of chicken laps has also increased by over 60 per cent YoY. The commodity, which cost about N1500 about a year again now goes for about N2,400 at popular supermarkets, while a whole chicken sells for N5,000.

A live chicken (old layer) costs about N2,500-N3,000 and a broiler costs a minimum of N5,000 in many live chicken markets in Lagos.

At a popular supermarket in Lagos, an 800-900gm sachet of milk is between N2,300 and N3,000, depending on the brand. About a year ago, the price of the essential commodity was in the range of N1,700 and N2,000.

A kilogramme of Titus fish is currently N1,600 just as Croaker fish is N2,500 as against the average price of N850, implying that fish has increased by over 100 per cent in the past year.

The survey revealed that only the price of beans, as a plant-based source of protein, has reduced significantly in the last two months as new harvests hit the market.

At Daleko market, Lagos, a bag of brown beans was N50,000 last month. But it has dropped to N32,000, while a big bag of sweet beans also fell from N105,000 last month to N75,000. The price of a small bag of white beans also slowed from N90,000 last month to N65,000.

In Ibadan, Oyo State, findings revealed that a crate of medium-sized eggs costs about N1,700, while a crate of big eggs is sold for between N1,900 and N2,000. The same price range applies in Kwara State. But in Abuja, a crate of eggs is about N2,500, while a kilogramme of chicken is about N3,000. The percentage increase across markets is between 40 and 70 per cent.

A medium-sized tuber of yam is N1,200 in a popular supermarket in Lagos while it costs about N1,000 on the street. A similar size of yam sold for about N700, or about 40 per cent less than the current price in open markets a year ago.

It is a similar trend for groundnut oil and onion. A bag of onion, for instance, has increased by over 70 per cent, with a five-litre groundnut oil increase from N4,000 to N7,000 at popular markets. Onion, though at a slower speed than oil, has increased by over 30 per cent YoY.

YET, NBS said the inflation rate has been on a decelerating trend in the past seven months, starting from April. The latest Consumer Price Index (CPI) survey puts the food inflation at 18.34 per cent. It had touched 22.95 per cent in March, the highest in over 10 years before it made a U-turn.

On its face value, Nigeria’s inflation rate contradicts global trend. From the United States to China and across Europe, rising inflation, which was earlier dismissed as transitory, is taking its toll on families and economies.

For many central banks, the choice between stimulating post-COVID-19 economic recovery and inflation control is a devil’s choice. Back home, some economists and other professionals have queried the inflation figures as unrealistic.

Some of them have called on the NBS to take Nigerians to the back-end process as the magnitude and direction of the figures defy market reality.

A professor of applied economics, Godwin Owoh, described the inflation figures as unusable, saying they were doctored to fulfill some political objectives. He said the figures would fall apart when subjected to professional scrutiny by an independent body.

Also reacting, a former President of Trade Union Congress (TUC), Peter Esele, questioned the metrics used by the NBS to measure the inflation rate.

Esele said: “I am sure many Nigerians will be asking if those working in the NBS come from the moon. Even the price of naira, which is the exchange rate, has gone up. The price of cooking gas has gone up by more than 100 per cent. The price of every commodity in the market has gone through the roof. So, I ask the NBS, what metrics did they use?”

Esele pointed out that if the prices of goods and services are rising at a faster rate in America, Britain as well as in all of Europe while it is in reverse in Nigeria, it suggests that Nigeria has a different definition of what inflation rate is.

“Why is the price of cooking gas going up? That is the trend in the international market. The British government is subsidising gas now because winter is here. What is the Nigerian government subsidising for its citizens? No one needs to speak about inflation decelerating or accelerating. The market is there to determine what the inflation rate is. The NBS cannot be saying exactly the opposite of what the market and the pockets of Nigerians are saying,” he stressed.

MEANWHILE, farmers have blamed insecurity for the persistent rise in food prices. They also warned that the post-harvest crisis could be more threatening.

President of All Farmers Association, Kabir Ibrahim, said it was a misnomer for food prices to be going up at harvest time. He was, however, quick to observe that insecurity and the dwindling value of naira were responsible for the price rise.

“I suspect this persistent food price rise is caused by the dwindling value of the naira and the fact that our production has also gone down owing to insecurity,” he said.

Also, the National President of the National Palm Produce Association of Nigeria (NPPAN), Alphonsus Inyang, said it was no brainer that food prices are on the rise.

He asked: “Why should we be surprised? Most farmers have abandoned their farms because of insecurity. Only a few people are farming. What we are doing is garden farming because people no longer go to big farms; they rather farm around their homes where they are close to their community.

“I am a major rice processor, as we speak, they have started harvesting rice paddy. The price of paddy today is higher than what it was last year even after harvest. The price now is N220,000 per tonne; it has never been like this even after harvest season. It is supposed to be N120,000 per tonne and maybe after harvest, increase to N150,000 per tonne.”

He said what the country is experiencing now in terms of high food prices is just the tip of the iceberg, adding that as long as the authorities have failed to address insecurity, food prices will continue to rise.

Also commenting, Prof. Leo Ukpong of the American University of Nigeria (AUN) said the reason consumers could not feel the drop in inflation was that the average things that consumers buy are either not included in the basket of goods used in the calculation of the CPI or very little is included in the index.

The CPI, as released by the NBS, shows that food inflation increased from 20.71 per cent in September 2021 to 20.75 per cent in October 2021 – a rise of about 0.4 per cent.

On a month-on-month basis, NBS said the headline index increased by 0.98 per cent in October 2021, which was 0.17 per cent lower than the rate recorded in September 2021.

According to the NBS, the percentage change in the average composite CPI for the 12 months ending October 2021 over the average of the CPI for the previous 12 months period was 16.96 per cent, 0.13 per cent point higher from 16.83 per cent recorded in September 2021.

The urban inflation rate, according to the body, also increased by 16.52 per cent YoY in October 2021 from 14.81 per cent recorded in October 2020 while the rural inflation rate increased by 15.48 per cent in October 2021 from 13.68 per cent in October 2020.