The Central Bank of Nigeria’s advances to the federal government rose 2900 per cent in the last seven years to N23.8 trillion, an unprecedented rise that violated the law, stoked inflation and worsened the country’s debt burden.

Central banks sometimes help governments to fund budget deficits, but such loans, called Ways and Means Advances, are tightly controlled as they can fuel inflation and distort monetary policy.

In May 2015 when the Buhari administration came to office, the CBN’s loans to the federal government stood at N789.7 billion cumulatively. Since then, the government has drawn central bank loans each year at an unprecedented level.

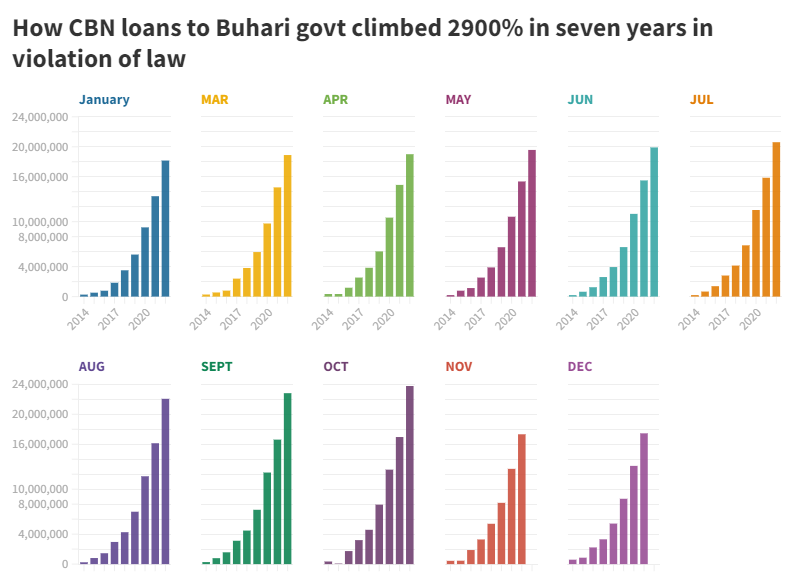

Between January and October 2022 alone, the government drew N5.6 trillion. By comparison, between December 2012 (the earliest date the CBN has released data for) and May 2015, a period of two and half years, ways and means advances rose by N654.9 billion.

As his administration winds down, President Muhammadu Buhari made an attempt on Wednesday to obtain a delayed approval for the loan that had already been spent, causing an uproar in the Senate. Lawmakers rejected the request and accused the president of violating the constitution. They also demanded details of how the money was spent.

The CBN Act says the CBN may grant temporary advances to the federal government in respect of temporary deficit of budget revenue at such rate as the bank may determine. It however warns that the total amount of such advances outstanding “shall not at any time exceed five (5) percent of the previous year’s actual revenue of the Federal Government.”

In addition, it stipulates that, “All advances shall be repaid as soon as possible and shall, in any event, be repayable by the end of the Federal Government financial year in which they are granted and if such advances remain unpaid at the end of the year, the power of the bank to grant such further advances in any subsequent year shall not be exercisable, unless the outstanding advances have been repaid.”

Analysts say all requirements of that legislation have been breached by the CBN under Godwin Emefiele and Finance Minister Zainab Ahmed.

If the regulation had been followed, the ways and means to the government for the entire 2022 should not exceed N219 billion (5 per cent of the government’s revenue in 2021).

Contents

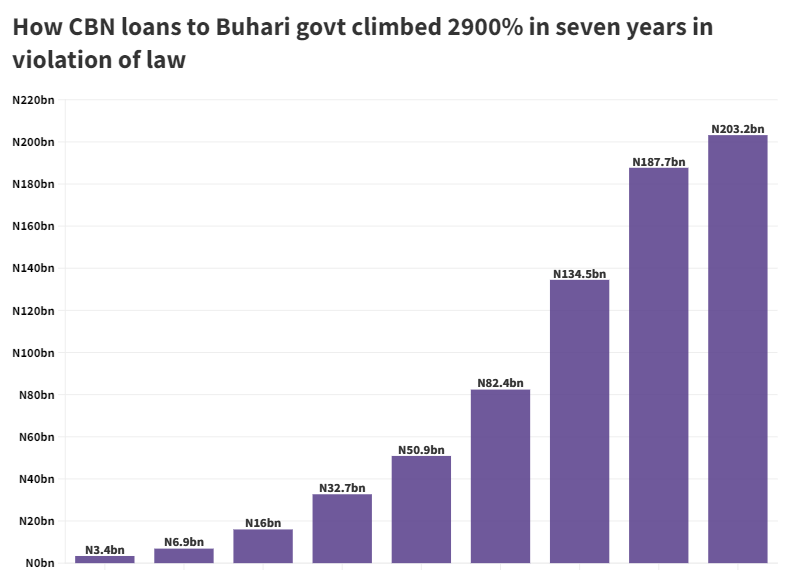

Yearly Advances

The bank’s loan as of December 2015 stood at N856 billion; it rose to N2.2 trillion in December 2016, and reached N3.3 trillion in December 2017.

By December 2018, the figure rose to N5.4 trillion and reached N8.7 trillion in December 2019. The amount was N13.1 trillion by December 2020 and N17.4 trillion by December 2021. It is now N23.8 trillion.

In October, the government said it was converting the CBN loans to bonds with a maturity of 40 years and an interest rate of nine per cent, effectively transferring the bill to the next generation.

Analysts say drawing so much from the CBN has opened the economy to severe risks. “Specifically the Debt to GDP now surpasses the 30 per cent benchmark the DMO and Minister of Finance always quote,” Kalu Aja, a finance expert, said of the advances.

“This is a contingent liability to the federal government, it narrows the ability to do more deficit financing and essentially guarantees taxes must rise to cover the deficit.”

He said injecting so much money into the economy has made Nigeria’s inflation worse.

“On the monetary side, one wonders the strategy of the CBN, they have monetized the deficit by excessive printing of the naira which will continue to cause inflation. Their response to fight inflation has primarily been to raise the monetary policy rate,” he said.

“A high MPR means SME cannot profitably borrow. Thus we see a clear linkage between excessive printing on behalf of the CBN and higher interest rates.”

Nigeria’s inflation reached 21.47 per cent in November 2022, rising for the 10th consecutive month. In response, the central bank raised the benchmark lending rate to 16.5 per cent.

‘Piggy Bank’

The International Monetary Fund in November warned that the CBN’s continued financing of the country’s deficit through ways and means will complicate the effort to contain inflation.

In November 2021, the World Bank also listed the sizeable “fiscal deficit financing” by the CBN as one of the factors undermining the business environment, compounding underlying constraints on domestic revenue mobilization, foreign investment, human capital development, and the delivery of public services.

In 2017, a member of the Monetary Policy Committee, Doyin Salami, criticised the CBN’s “massive injections of cash” into the economy, accusing the bank of serving as a “piggy bank” for the government, against its own rules.

He said the CBN’s claims on the federal government at the time were “twentyfold higher” than what the law permits.

In December 2016, a former governor of CBN, Sanusi Lamido Sanusi, raised concern over the violation of the CBN Act concerning the financing of the government’s deficit.

“The CBN-FGN relationship is no longer independent. In fact, one could argue their relationship has become unhealthy. CBN claims that the FGN now tops N4.7 trillion – equal to almost 50 percent of the FGN’s total domestic debts. This is a clear violation of the Central Bank Act of 2007 (Section 38.2) which caps advances to the FGN at 5 percent of last year’s revenues. The overdrafts alone are equal to more than 10 times that prescribed limit and are growing every month,” The Cable quoted him as saying.

In August 2022, Kingsley Moghalu, a former deputy governor of the bank, also criticised the CBN’s actions.

“In the current scenario, the leadership of the Bank evidently does not believe in the concept of central bank independence in its operations. Rather, the Bank asks “how high?” once the Presidency says “jump”. It sees itself as a quasi-fiscal agent, using its ability to print money, for the government of the day,” he said.

“If the CBN is busy printing money for the government through illegal Ways and Means lending, and then pretends to be fighting inflation by belated raises of the Monetary Policy Rate and what one commentator aptly termed a “dubious” cash reserve ratio policy on commercial banks, how can we fight inflation successfully?” he wrote in an opinion piece.