A few weeks ago, I caught up with some old friends & we had a discussion regarding cryptocurrencies. When talking about their personal holdings, one thing I found very interesting was how their strategies were all similar and mirrored a huge majority of crypto investors.

Instead of doing proper research, having a trading plan, learning technical analysis, and making strategic movies, their strategy was simply to “HODL”.

To get a deeper understanding of why they chose to invest their money into the coin they did, I asked for their reasonings. The response I received was they thought the coins were strong investments as they “would surely pump x10 or x100 within the next few months.”

You’ve probably heard the saying “ If you don’t sell, you don’t lose” by some crypto maximalists before. This perfectly encapsulates how uninformed the majority of the crypto space is about investing or trading.

Most investors do little to no research, have no idea about the market cap of the coins they hold, and have done zero technical or fundamental analysis. They simply buy because of what they heard from strangers on social media.

Even calling this “investing” is being generous. It’s gambling.

Contents

1. Understanding Market Cycles

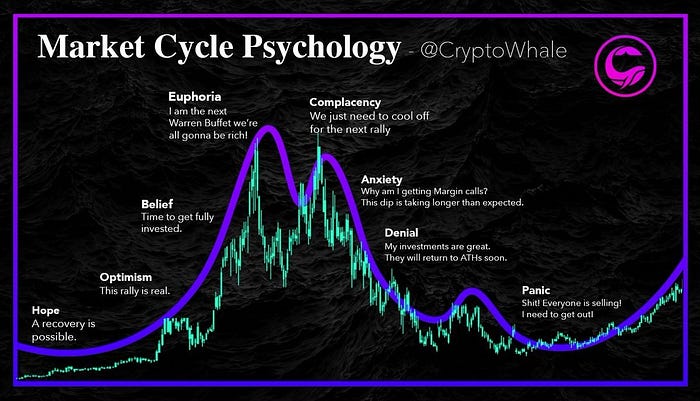

These are a set of distinct phases between the peak and low of a market. Understanding the different phases is essential as it can help you prepare and predict future price movements.

Market cycles offer a macro perspective on market fluctuations, which provides a useful contrast to the daily volatility seen in the crypto market. If used correctly, it can provide you with the perspective you need to execute great trades and avoid making costly mistakes.

Some market cycles are separated into four phases, including the accumulation phase, the mark-up phase, the distribution phase, and the mark-down phase. This is a very useful method, especially for quick reference, however, there is a lot more nuance in using the more traditional model, which contains 8 different stages.

Stage 1: Hope

“A recovery is possible.”

Hope is the first sign of recovery after serious disbelief. The market is showing positive signals for a new bull run but investors are still cautious.

Stage 2: Optimism

“This rally is real.”

The price has potentially broken above the previous failed rallies and investors are now optimistic that this rapid rise is the real deal.

Stage 3: Belief

“Time to get fully invested.”

The momentum is continuing to build. Investors are excited to invest a large portion of their money in promising projects.

Stage 4: Euphoria

“I am a genius! We are all going to be rich.”

The price of almost every market is through the roof. Investors have become euphoric because their portfolio value has never been higher. This stage represents the top of the bull market.

Stage 5: Complacency

“We just need to cool off and wait for the next rally.”

Soon after the euphoria has set in, there is a significant crash in price as whales begin to take profits and bears begin to short. Many investors hold onto their coins, or buy more, believing that this is just a dip. And indeed, the price does rally upwards again but does not break the previous high.

Stage 6: Anxiety

“This dip is taking longer than expected.”

After the complacency rally fails to break the previous high, the price begins to fall again, this time lower than the previous support. Investors become anxious as they are now close to breaking even or losing money on most of their investments.

Stage 7: Denial

“My investments are with solid projects. They’ll come back. There will be a new all-time high soon.”

Investors have now lost money on their investments and are in denial that the market is in a downtrend.

Stage 8: Panic

“Oh no! Everybody is selling. I need to get out.”

The price continues to fall lower and lower, seemingly confirming a bear market. Investors now see the truth and understand that they need to get out, but they are hesitant to sell at such a big loss.

2. Dollar-cost averaging

When Investing, your average buy-in price is very important. You obviously want to get in as low as possible, and many times, people only “see” the opportunity when the asset has already surged to all-time highs.

Going all-in at the peak is a guaranteed way to go bankrupt.

Instead, many use a strategy called Dollar-cost averaging. This involves investing smaller amounts of money on a regular basis, especially on market declines. It is a particularly powerful strategy in volatile markets such as crypto. It can also be a good way to avoid making emotional trades.

The main drawback of DCA is that often your profits would be higher if you bought EARLY with a lump sum. But this is difficult to predict, particularly for people new to crypto or investing.

The majority of people will never catch the tops or bottoms, which is why Dollar-cost averaging in a bull market and slowly taking profit as we enter a bear market is essential.

Example of Dollar-Cost Averaging:

If you have $50,000 to invest, rather than investing $50,000 at once, you would invest over time — let’s say $1,000 to $5,000 a month. This lowers the risk of having to perfectly time the market in order to make the best return.

For example, let’s say you invested your $50,000 in Bitcoin in September 2017 when it was valued at $3,500, and then you sold in December 2017 at $17,000 — you would have exited with $242,857! Not bad for a three-month investment.

However, what if you’d invested your money in Bitcoin at $17,000, only to see it rise to over $19,000 and then drop to $8,000 in March? Your investment value will have more than halved, falling to $23,529.

This is the risk of trying to time the market. Instead, by investing a small amount at a time, you benefit from both the highs and the lows. If the market falls, you only spent a few thousand of the total amount you had available to invest at that high price point, so it’s not that big a loss — you just continue investing over time, getting more of the asset you believe in at a discounted rate. This lowers the average amount you’ve spent per Bitcoin over time, which means the average profit per Bitcoin also increases as its value goes up.

3. Diversification Strategy

Anyone who’s traded crypto knows how volatile the markets can get. If you don’t want to get hit with massive drops and aren’t an active day-trader, diversification might be a great option for you.

A common question that comes up when discussing crypto diversification is whether diversification is even possible? Most altcoins have some correlation with Bitcoin, so they argue that investing in altcoins isn’t a true form of diversification.

This may have been true in the past. However, today there are a range of crypto projects available that have different purposes to Bitcoin, which may lead to differences in price performance as the market becomes more established

In fact, Bitcoin has been one of the worst-performing coins in the top 100 during the 2020–2021 bull market. Its growth may impress some, but altcoins are being adopted and bought at a much faster rate.

In the long run, do you really think Bitcoin will shine? It’s the only coin still stuck on Proof of Work, which is slow and destroys the environment. Its fees are insanely high, the network’s always congested, 12 years and only adopted by a single tiny corrupt country, and heavily manipulated by insiders.

Those facts don’t instill too much confidence, which is why I think it’s essential for crypto investors to diversify into other coins with real utility and various use-cases.

For example, while BTC claims to be a payment method on its white paper, it obviously fails at that. So opting for instant and cheap alternatives like XRP, Nano, or BSV could be promising for the long-term.

Top crypto diversification strategies

So, now that we’ve covered why it’s worth diversifying your crypto portfolio, the next question is how? Here are our top crypto diversification strategies.

1. Diversifying the type of cryptocurrency

As mentioned earlier, there is a wider range of crypto projects available than ever before, which gives you a greater selection of investment opportunities. However, please take note that making a random selection of tokens and putting 10% of your money into each isn’t the best approach.

Instead, identify the different types of cryptocurrencies available, and ensure your portfolio represents each of those types. Different types of cryptocurrencies include:

- Transactional tokens: Tokens designed to be used as a form of currency, like Bitcoin.

- Smart contract tokens: Are protocols such as Ethereum, or Polkadot that allow using blockchain technology to develop decentralized applications, run smart contracts on its own platform as well as peer-to-peer payments.

- Utility tokens: Tokens integrated into an existing blockchain protocol and used to access its services. A great example is XRP, which is currently being utilized by many banks and companies around the world.

- Fiat: If you want to protect your wealth from short-term market corrections, which are likely, you can also hold fiat. And no, not unregulated and fraudulent stable coins like Tether. I’m talking about real US dollars, held in your government-insured and safe bank account.

2. Diversifying by industry

Like investing in stocks from different sectors to protect yourself should one sector take a hit, you can also invest in cryptocurrencies that fall into different industries. Some of the industries with crypto projects include:

- Finance

- Decentralized finance (risky now, but will get better)

- Data and analytics

- Medicine

- Identity

- Supply chain

- Artificial intelligence

- Energy

You can also take the same approach with regional diversification — or investing in crypto projects from different parts of the world.

4. Profit Taking

Profit-taking is something that’s absolutely essential, yet almost nobody talks about it. That’s because many in this space want to front-run others, and not be the last one out.

As the markets rally due to Tether price manipulation and extreme speculation, we shouldn’t ignore the many looming threats that could trigger a cataclysmic market crash (Mt. Gox dumping 150K BTC, Tether regulations incoming, Institutional demand fading, Peak Greed/Euphoria, etc…)

While I’ve never advised people to open short positions (due to market manipulation risks), I am a strong proponent of profit-taking and building a strong exit strategy.

Unrealized profits aren’t profits. At the peak of the last bubble in 2017, almost everyone in this space became insanely rich… on paper. That all disappeared in 2018 after the markets dropped by 85–99%.

This will undoubtedly happen again, and you must be prepared.

5. Play With Only What You Can Afford to Lose

I’ve conversed with hundreds of individuals sharing their stories of how they invested more than they could afford, and lost it, leaving them in financial ruin. This can be easily avoided.

The markets are so volatile, and in for many major corrections and pumps in the future as society continues to speculate upon its true valuation. It’s irresponsible to be over-invested in such a risky asset class.

Another thing: Avoid Leverage! Most of these centralized crypto exchanges are extremely corrupt and know everyone’s positions. They make millions when you’re liquidated, hence why you always see them suspiciously go offline before big moves (so people can’t close trades).

If you have trouble sleeping at night or would be bankrupt if your entire crypto portfolio plunged to zero, you clearly are over-invested.

6. Don’t Be Greedy

Going back to points #4, and #5, they are largely impacted by greed. When the markets are green, and everyone is euphoric, greed blocks people from wanting to secure those profits.

In fact, the higher the prices rise, the more FOMO we witness. This emotion is dangerous, and a key component behind every market bubble to exist.

Don’t forget that the markets are essentially a graph displaying human emotion. When everyone is greedy and bullish, you should be bearish.

The Influence of Greed

Most people want to get rich as quickly as possible, and bull markets invite us to try it. The Internet boom of the late 1990s is a perfect example. At the time, it seemed all an adviser had to do was pitch any investment with “dotcom” at the end of it, and investors leaped at the opportunity. Accumulation of internet-related stocks, many of them barely startups, reached a fever pitch. Investors got exceedingly greedy, fueling ever more buying and bidding prices up to excessive levels. Like many other asset bubbles in history, it eventually burst, depressing stock prices from 2000 to 2002.

As fictional investor Gordon Gekko famously said in the movie Wall Street, “greed is good.” However, this get-rich-quick thinking makes it hard to maintain a disciplined, long-term investment plan, especially amid what Federal Reserve Chair Alan Greenspan famously called “irrational exuberance.” It’s times like these when it’s crucial to maintain an even keel and stick to the fundamentals of investing, such as maintaining a long-term horizon, dollar-cost averaging, and ignoring the herd, whether the herd is buying or selling.

7. Don’t Follow The Herd

The key to enduring success in trading is to develop an individual, independent system that exhibits the positive qualities of studious, non-emotional, rational analysis, and highly disciplined implementation. The choice will depend on the individual trader’s unique predilection for charting and technical analysis. If market reality jibes with the tenets of the trader’s system, a successful and profitable career is born.

Charles Mackay’s famous 1852 book, “Extraordinary Popular Delusions and the Madness of Crowds,” is perhaps the most often cited in discussions of market phenomena, from the tulipmania in 17th-century Holland to most every bubble since. The story is a familiar one: an enduring bull market in some commodity, currency or equity leads the general public to believe the trend cannot end. Such optimistic thinking leads the public to overextend itself in acquiring the object of the mania, while lenders fall over each other to feed the fire.

Eventually, fear arises in investors as they start to think that the market is not as strong as they initially assumed. Inevitably, the market collapses on itself as that fear turns to panic selling, creating a vicious spiral that brings the market to a point lower than it was before the mania started, and from which it will likely take years to recover.

Right now, the herd is overwhelmingly bullish. Almost every “crypto influencer” is projecting a massive surge to $100K–200K before the end of 2021. This is unlikely to happen.

Thank you for reading!

Did you know that each medium user can clap an article up to 50 times per day for free? If you want to show your support, I’d truly appreciate it!

Looking to become a member on Medium, and read unlimited articles from me, and thousands of others? Sign up using my special link, which will get you an amazing deal. cryptowhale.medium.com/membership